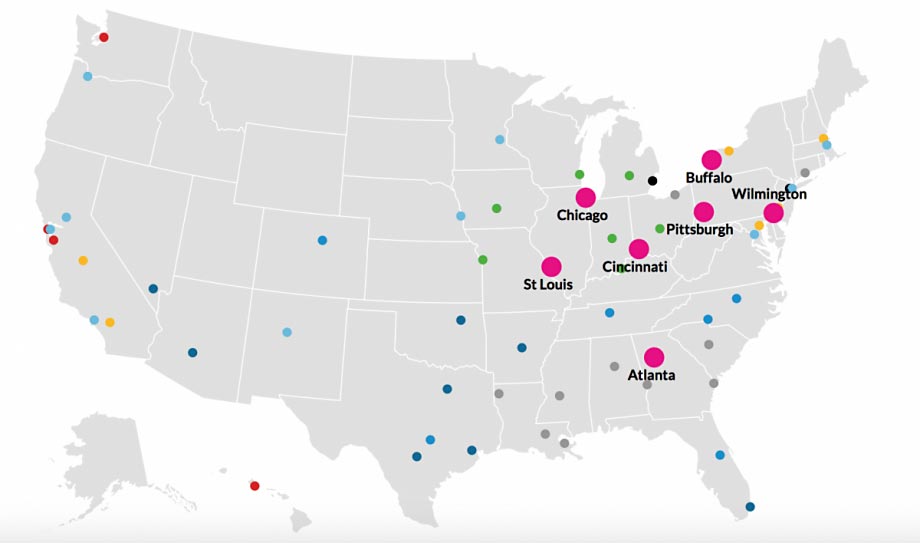

“Chicago and Buffalo—two cities that aren’t often paired by similar characteristics—actually have a lot in common when considering financial factors like credit scores, delinquent debt and housing cost burden,” reports Rachel Dovey for Next City. “The two cities, along with Atlanta, Pittsburgh and St. Louis, fall under the category of ‘Cities with Tenuous Stability and Uneven Opportunities,’ in a new interactive report released by the Urban Institute called The Financial Health of a City.” “The report features 60 cities grouped by credit bureau data, census and ACS figures, the Federal Deposit Insurance Corporation’s (FDIC) National Survey of Unbanked and Underbanked households and Brookings Institution tabulations of IRS data. Researchers pooled those sources to find indicators of ‘financial health,’ which is defined as ‘multidimensional.'” “The report says it examines metrics that reflect three dimensions of residents’ financial health: ‘residents’ ability to manage daily finances, be resilient to economic shocks, such as an income drop or unexpected expense, and pursue opportunity to move ahead.’ Researchers then broke the cities into ‘peer groups’ by similar characteristics. The group including Chicago and Buffalo has mixed economic conditions and stagnant or shrinking populations—although Atlanta is an exception. It’s also defined by sharp racial inequities.” “‘Financial security … is above average with prime median credit scores,’ the report states, adding that ‘sizeable racial disparities exist in credit health; these cities have the largest disparity in median credit score between predominantly white and predominantly nonwhite neighborhoods.'”